Handling Losing Trades: Turning Losses Into Learning Opportunities

Have you ever faced a losing trade and felt disheartened? It’s not just about the loss, but about using it as an opportunity to learn and improve your trading strategy. Let’s dive into how to turn setbacks into a path to future success.

1. Causes of Losses: Identifying Key Missteps

Losing trades often stem from a few common mistakes:

- Incorrect Market Analysis: Sometimes the market moves unexpectedly due to signals being misinterpreted or overlooked.

- Emotional Decision-Making: Trading on impulse, driven by fear or greed, can cloud judgment and lead to poor decisions.

- Unsuitable Trading Strategies: Not all strategies work for every trader. It’s important to find one that matches your risk tolerance and trading style.

2. Emotional Impact: Managing Your Trading Emotions

Trading isn’t just about numbers—it’s about psychology. Recognizing how emotions influence decisions is key to avoiding impulsive moves.

- Emotional Control: Identify triggers that lead to emotional decisions and adopt strategies like setting strict trading rules or taking breaks to stay focused.

- Stress Management: Stress clouds judgment, so practicing regular self-care (e.g., exercise, meditation, hobbies) can help you maintain clarity and composure during trades.

3. Market Analysis: Using Effective Techniques to Improve Decisions

A solid grasp of market analysis helps minimize losses and makes for smarter trades.

- Sentiment Analysis: Gauge the overall market mood to predict potential price movements.

- Technical Analysis: Use charts and patterns to spot trends and make informed decisions.

- Fundamental Analysis: Consider economic indicators and company fundamentals for a broader view of market conditions.

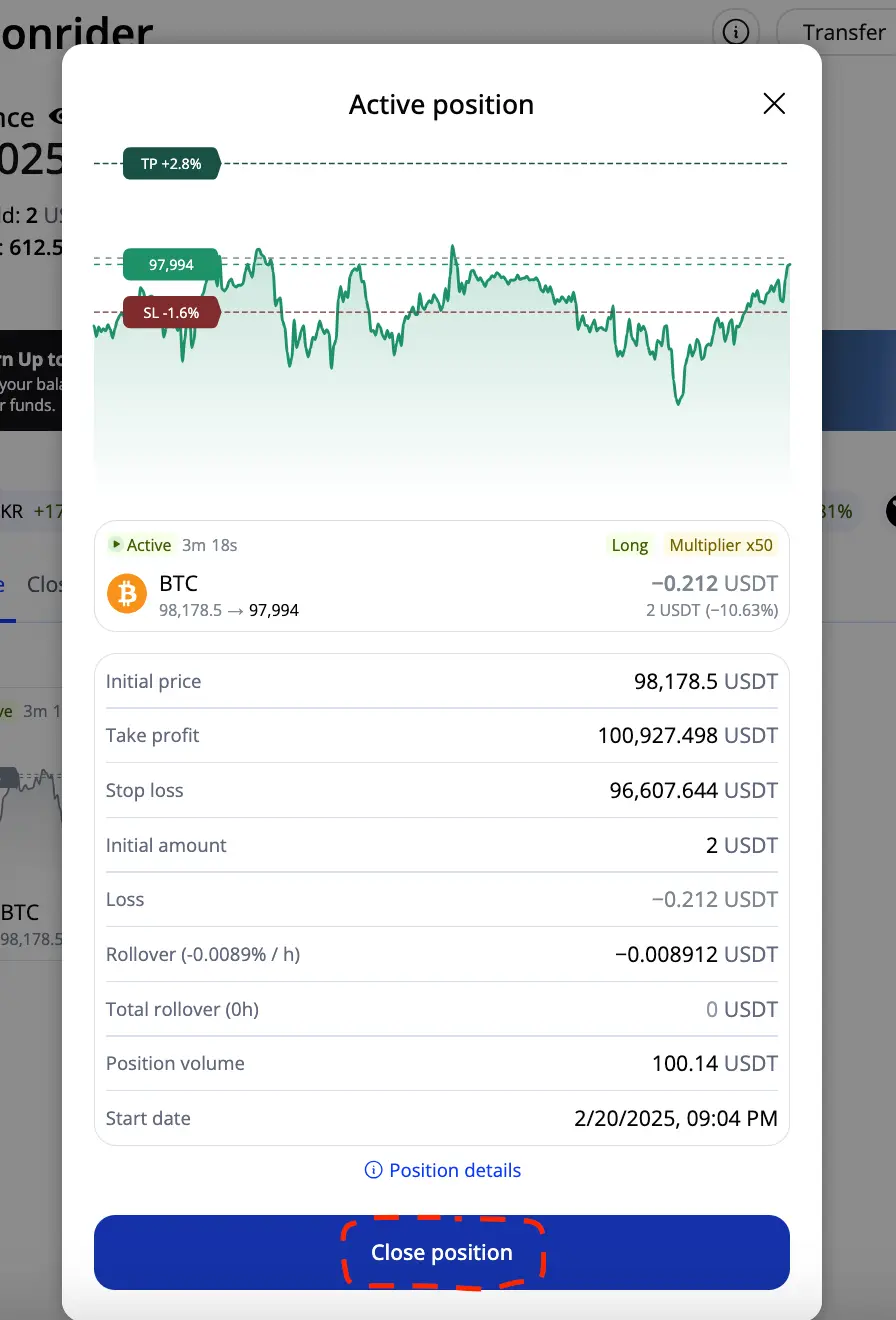

4. Cutting Losses: Know When to Close a Losing Trade

Sometimes, the best decision is to cut your losses and move on. Holding onto a losing trade in hopes of a reversal often leads to deeper losses. Know when to pull the trigger and close the trade to minimize damage.

5. Trade Cancellation: How to Cancel an Active Trade

To cancel a trade, go to your ‘Trades’ menu, locate the active trade, and select the option to cancel. Confirm the action to immediately close the position and limit your potential losses.

Final Thoughts: Embrace the Learning Curve

Every trade—win or lose—provides a valuable learning opportunity. By identifying areas where your analysis, strategy, or emotions led you astray, you can refine your decision-making process and become a more confident trader.

Start applying these insights today and take advantage of the tools available on our platform. Whether it’s rethinking a trade, managing emotions, or analyzing the market with new techniques, we provide everything you need to trade with confidence.