Risk Management Basics

Did you know that successful trading isn’t just about predicting market moves but also about managing risks effectively? Let's explore key risk management strategies to help you trade smarter and stay profitable.

Key Principles:

- Invest Smartly – Trade only with money you can afford to lose.

- Risk Management – Limit exposure to 1-5% of your account per trade.

- Diversify – Spread investments across different assets.

- Use Trade Cancellation – Exit bad trades when needed.

- Stick to Your Plan – Follow your trading strategy consistently.

1. Invest Smartly

Trade with peace of mind by only investing funds you’re comfortable losing. Think of it as financial insurance—you minimize stress and avoid risking essential funds.

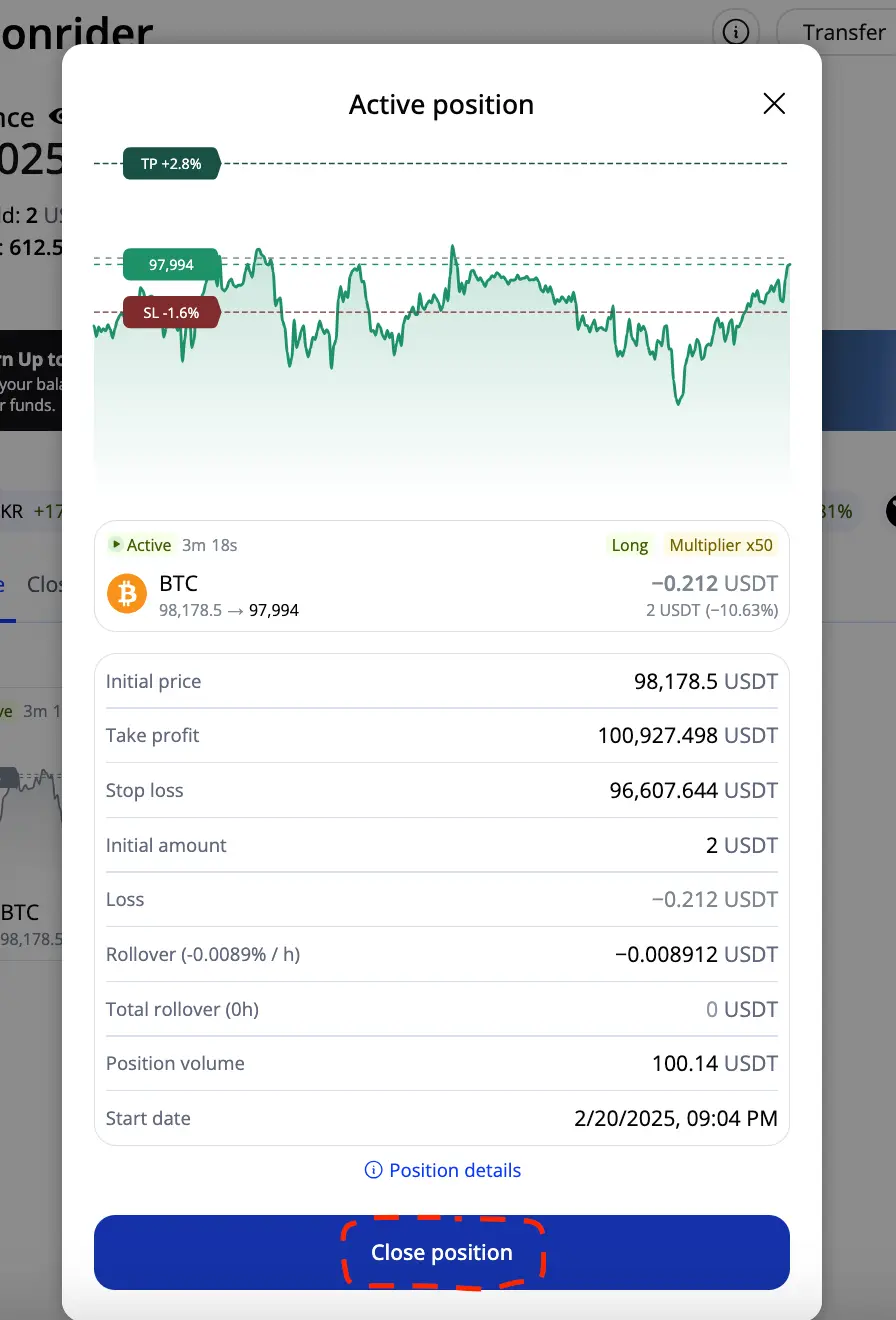

2. Risk Management: Spend Wisely

In trading, consistent wins matter more than one big gain. Keep risks low by limiting each trade to 1-5% of your total balance. This strategy prevents major losses and helps sustain long-term success.

3. Diversify: Spread Your Risk

Don't put all your eggs in one basket. Invest in a mix of cryptos like BTC, ETH, BNB, and others. This way, gains in one market can offset losses in another, reducing overall risk.

4. Trade Cancellation: Minimize Losses

If a trade moves against you, use the cancellation feature to exit early and limit losses. Having an exit strategy can be a game-changer in risk control.

5. Stick to Your Plan

Your trading plan is your roadmap. Define your:

✔ Goals (profit targets, growth strategy)

✔ Risk tolerance (acceptable loss levels)

✔ Entry & exit criteria (when to buy/sell)

By following a structured approach, you remove emotions from decision-making and build long-term consistency.

✅ Smart trading is about informed decisions, not luck. Manage your risks, diversify wisely, and stick to your strategy to maximize your chances of success.

Ready to apply these principles and level up your trading? 🚀