2025 in Numbers: What Changed and How to Prep for 2026

2025 is wrapping up — happy upcoming 2026! ✨

The crypto market is positioning for growth as major central banks ease policy and funding conditions look set to improve.

Below are this year’s key stats and a few ideas for the road ahead.

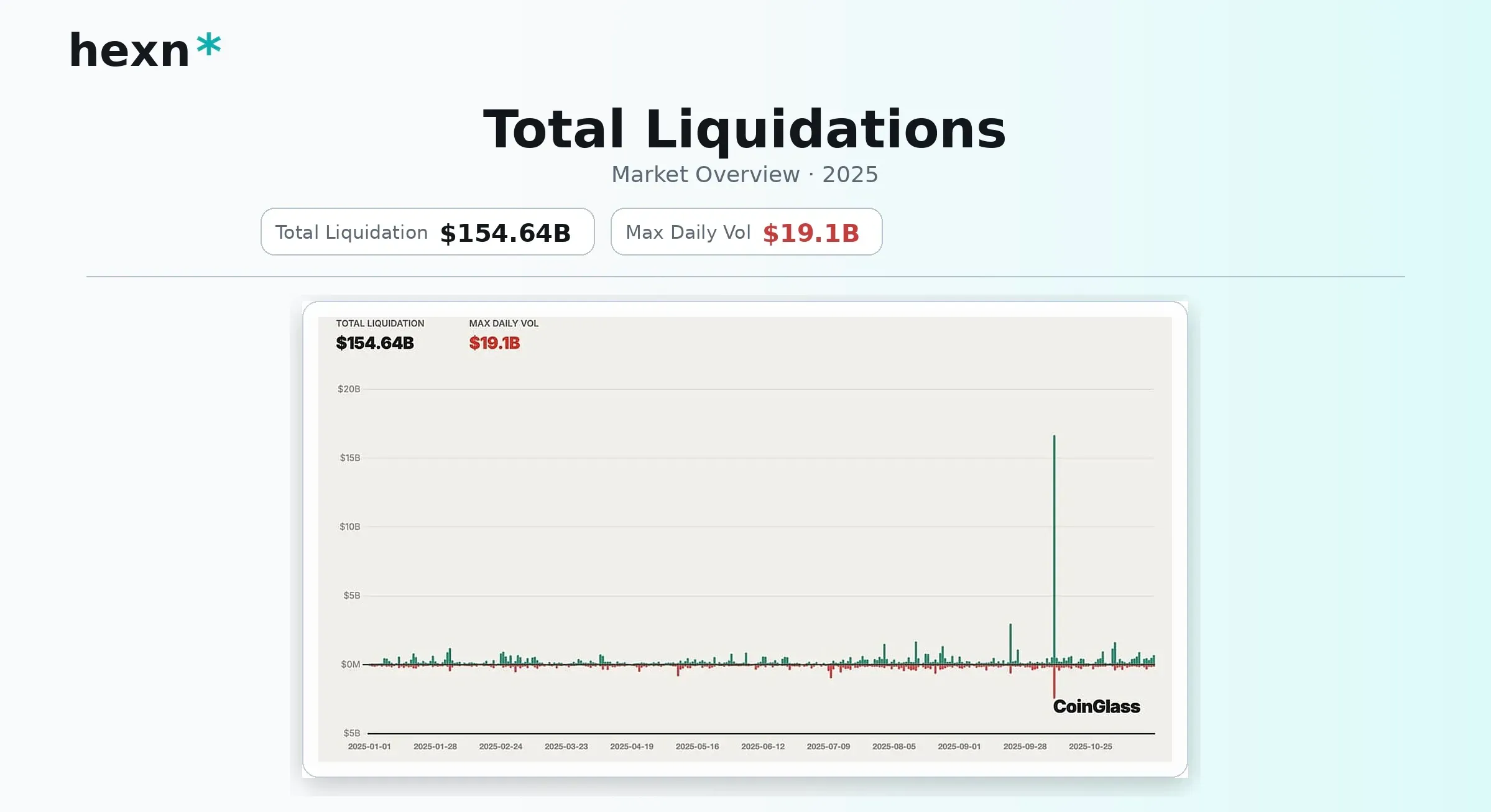

Derivatives

Total crypto derivatives volume in 2025: ~$86T (avg ~$265B/day), per CoinGlass.

Forced liquidations this year: ~$150B; the biggest 24-hour spike came on Oct 10–11 (~$19B).

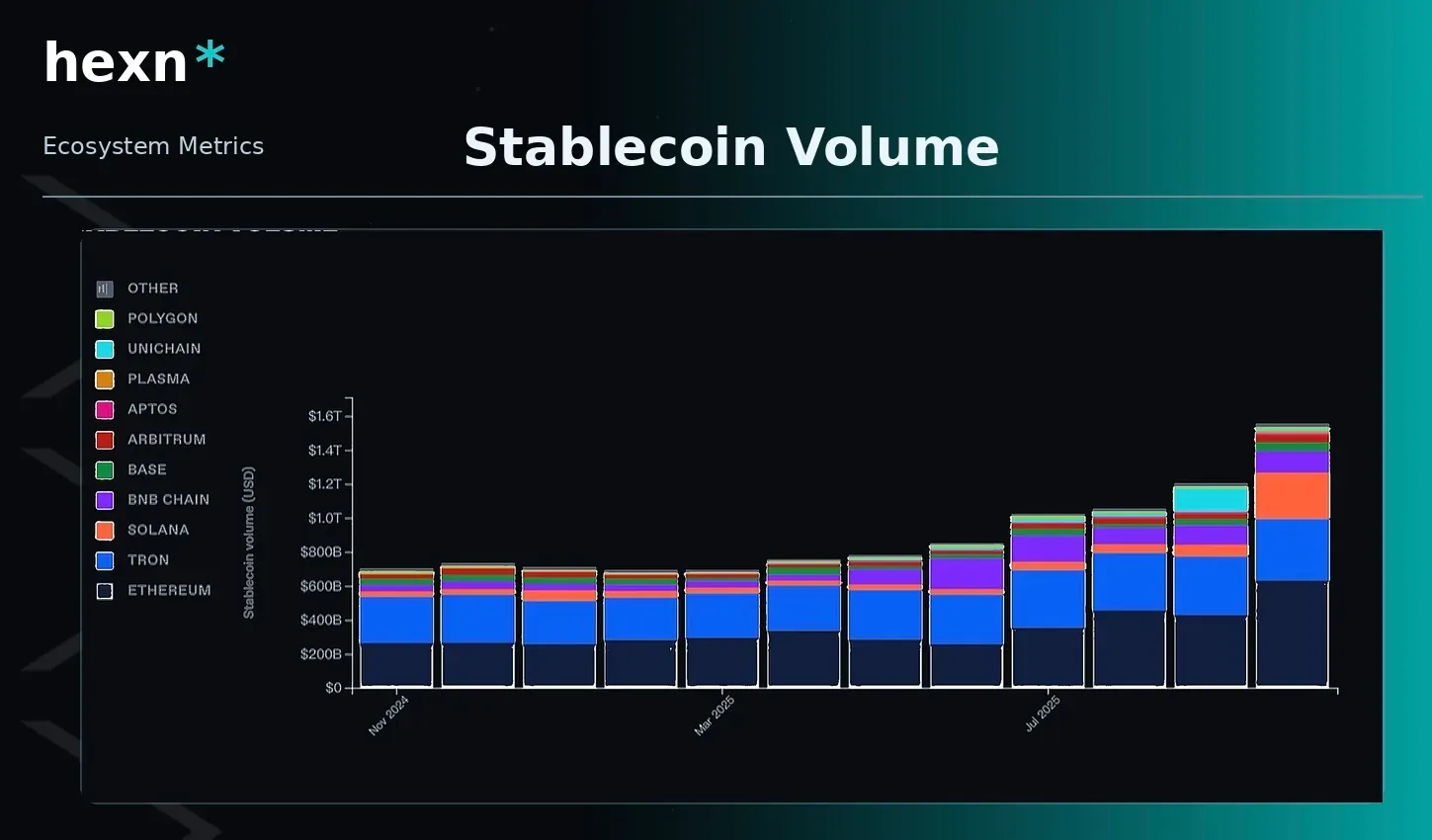

Stablecoins & DAT

Stablecoins broadened real-world use and plugged directly into TradFi: total market cap temporarily topped ~$230B, with ~$1.5T in on-chain settlement volume for the year.

The DAT model (tokens/funds built on compliant equity or fund instruments) gave institutions a standardized path into crypto: at the peak, BTC+ETH held via DAT exceeded ~$140B in market value (>3× YoY).

RWA

Real-world assets (RWA) acted as a key bridge: anchoring real cash flows on one side while connecting to on-chain settlement/valuation systems for stablecoins and DAT on the other.

The BCG × Ripple 2025 report projects tokenized assets to grow from ~$600B today to ~$18.9T by 2033 (CAGR ~53%), laying a foundation for long-run scale.

Security

On Dec 25, reports emerged of missing funds from Trust Wallet users in Google Chrome. Losses typically occurred after unlocking the wallet in the browser extension. On-chain analyst ZachXBT estimates total damages at >$6M. Safety checklist: use cold storage, unique keys/seed phrases, and isolate browser profiles.

Top-5 Crypto Hacks of 2025

- Bybit — ~$1.5B

- Cetus Protocol — ~$223M

- Balancer (cross-chain exploit) — ~$128M

- Nobitex — ~$90M

- CoinDCX — ~$44M

Regulation (EU)

Spain tightens rules from 2026:

MiCA from July 1 — mandatory licensing for crypto service providers.

DAC8 from Jan 1 — transaction/balance reporting to EU tax authorities.

Potential 2026 IPOs

A shortlist of major candidates to watch—as ideas for future positioning.

Takeaway

The market matured this year. Beyond the big macro swings, we saw growth in perpetual DEXs, mass-market stablecoins, and large funds testing tokenization of real assets.

On-ramps got simpler, on-chain prediction markets evolved from experiments to tools, and rules in key regions became clearer.

What that means for 2026: more liquidity, less friction between TradFi and blockchain—and, most importantly, more transparency for investors.

Thank you for being with Hexn this year. Here’s to 2026—may it bring more green days and goals achieved!