A Week of Shifts: Vanguard, Fusaka, Kalshi — Where’s the Opportunity for Your Portfolio?

The week was a study in contrasts: MicroStrategy dialed back its aggressiveness for the first time in years, Vanguard reversed a long-standing policy to allow funds with crypto exposure, and a major upgrade went live on the Ethereum network.

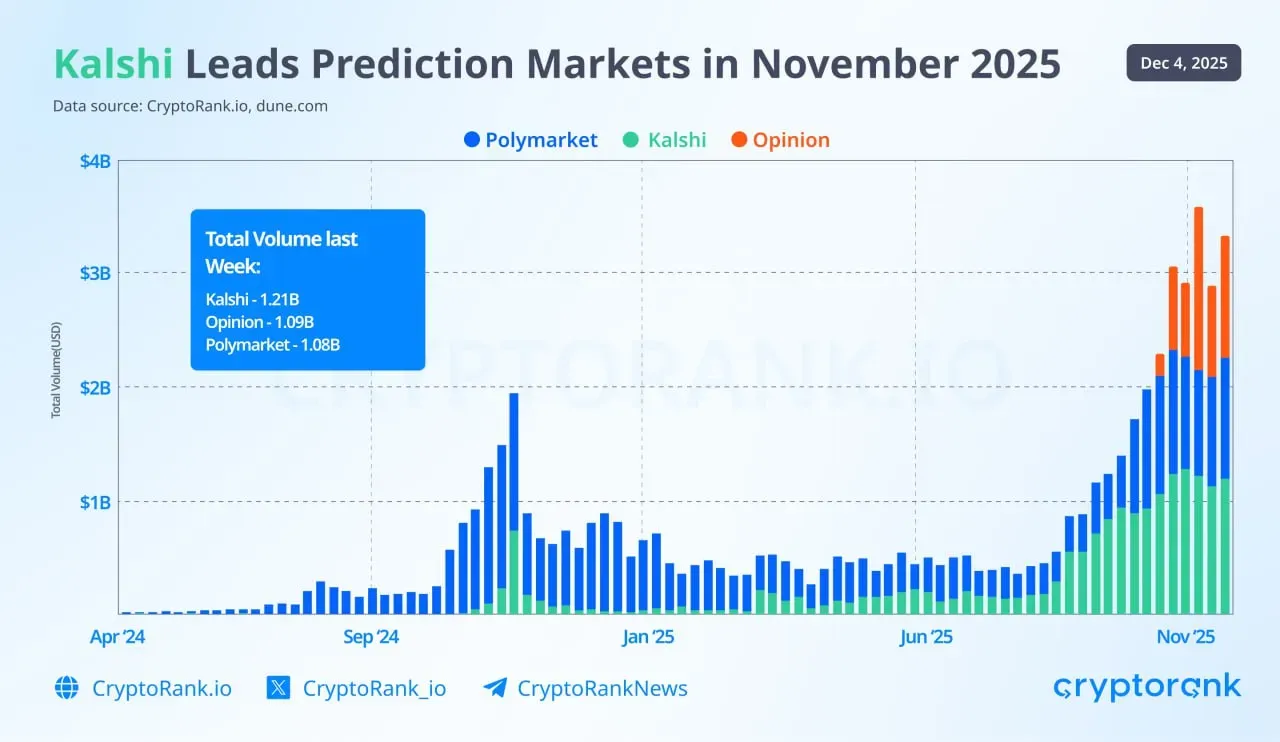

Prediction Markets: Kalshi #1, Record November

Kalshi closed November with a record monthly volume of $4.54B, slightly above October ($4.49B), confirming accelerating interest in prediction markets.

On November 21, Kalshi raised $1B at an ~$11B valuation—one of the year’s largest rounds in the fintech/crypto-adjacent space. The segment is expanding: media and brokers are integrating prediction-market data and products more actively.

Venture money is again flowing into infrastructure around “event markets,” and November set a volume record for the category leader. Investor takeaway: watch liquidity and institutional presence across Kalshi/Polymarket, and how fast these markets make it into mainstream apps.

(Source: CryptoRank)

(Source: CryptoRank)

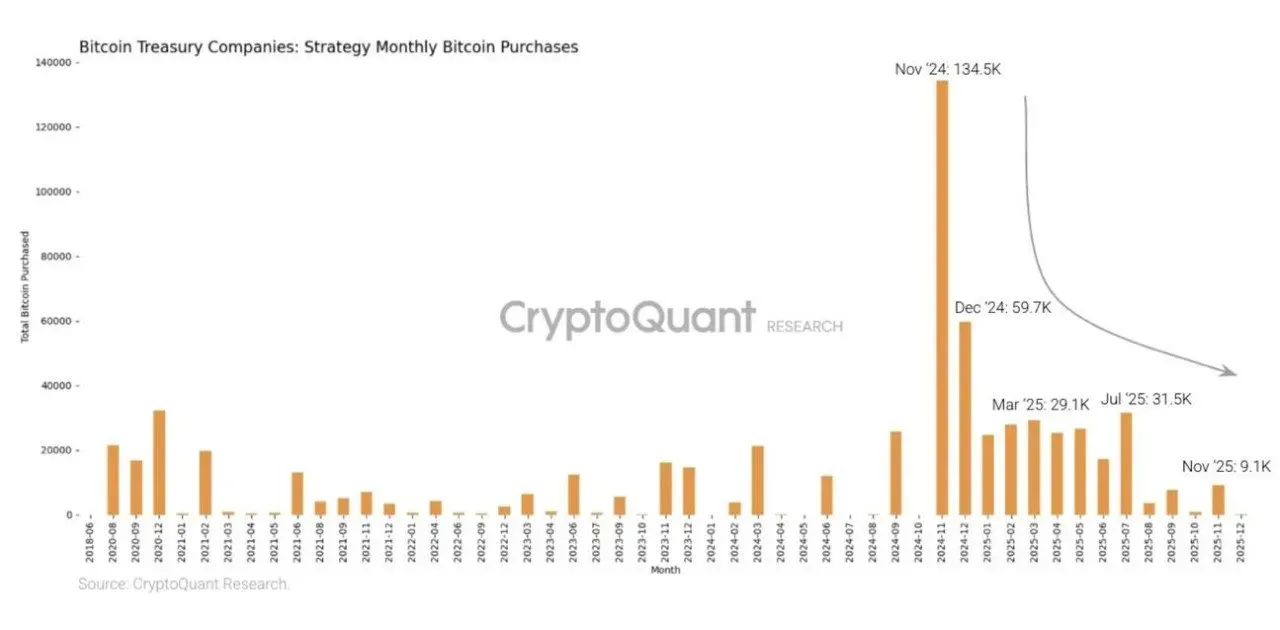

MicroStrategy’s Stance

According to CryptoQuant, the company built a cash reserve of ~$1.44B and is open to hedging—instead of the usual “all-in BTC.”

(Source: CryptoQuant)

(Source: CryptoQuant)

Ethereum: Fusaka Upgrade

On December 3, the Fusaka upgrade activated on Ethereum, boosting throughput and lowering fees. The next major upgrade, Glamsterdam, is planned for 2026.

Vanguard’s Pivot

Vanguard, the world’s second-largest asset manager, will for the first time allow trading of ETFs and funds with cryptocurrency exposure. Products tied to BTC, ETH, XRP, and SOL are becoming available on the platform. This breaks the firm’s prior anti-crypto stance and broadens channels for institutional inflows.

(Source: Bloomberg)

(Source: Bloomberg)

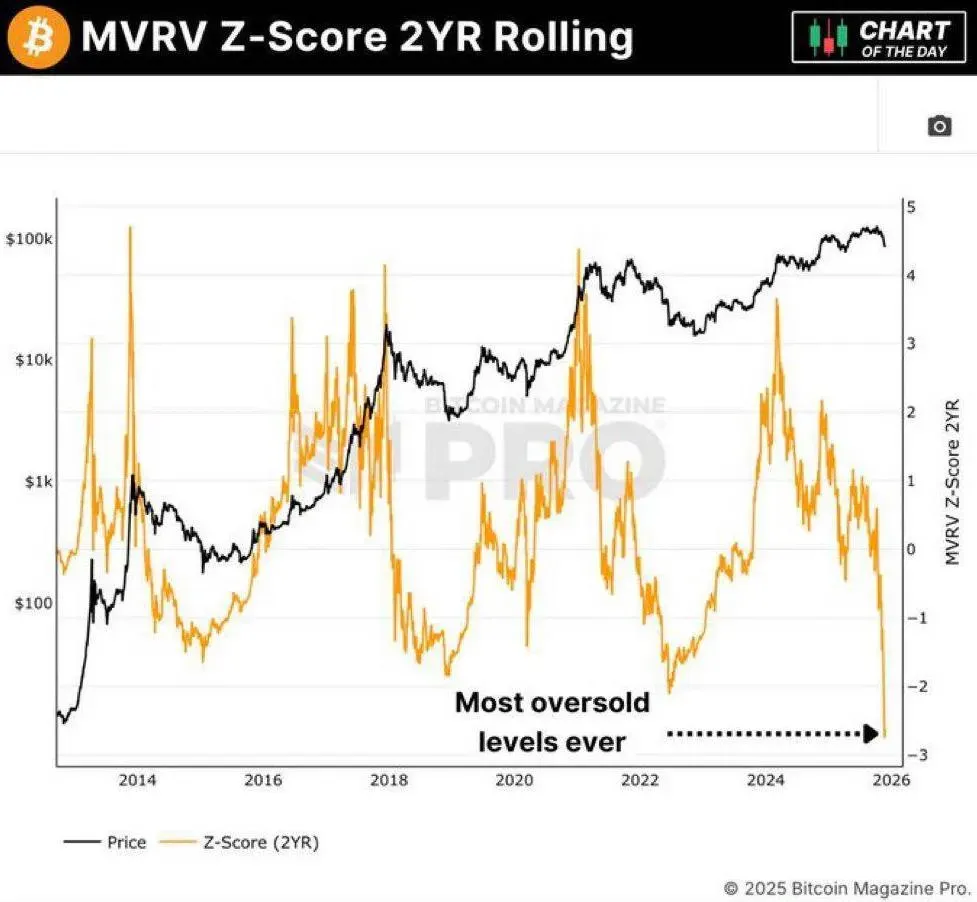

Market: BTC at Historically Oversold Levels

BTC has fallen to the most oversold readings on record. Current indicator levels align with zones that previously marked major reversals (the 2018 bottom and the 2022 shocks: FTX/LUNA).

In past cycles, such zones often preceded recoveries (not a guarantee and with no fixed timing).

(Source: bitcoinmagazinepro)

(Source: bitcoinmagazinepro)

Autumn Leaders

DropsTab shared the top coins by funds raised that came to market this fall.

Incident of the Week

Hackers breached USPD for ~$1M. Reminder: infrastructure risks haven’t gone away—even smaller projects can trigger cascading losses.

(Source: Decentre)

(Source: Decentre)

What it Means

We’re in a phase where discipline and liquidity matter more than big ideas. Vanguard’s turn is a positive for long-term demand, and Ethereum’s upgrade is a plus for on-chain costs, but near-term tone is still set by on-chain signals and USD liquidity.

If you want to ride out the turbulence with less stress, consider fixed-income products up to 20% APY, with weekly payouts and flexible risk settings.