Crypto Market Weekly: Fed Rate Cut, XRP ETF Hype, MFAANG Earnings, and $20B Onchain Revenue Boom

Markets entered November with a wave of mixed signals. In this week’s digest, we’ll break down the most important news shaping crypto and investment markets.

1. Fed Cuts Rates and Ends QT — But Bitcoin and Ethereum Stay Under Pressure

The Federal Reserve lowered its key interest rate from 4.25% to 4.00% and announced the end of its Quantitative Tightening (QT) program starting December 1 — a move that usually boosts liquidity and supports risk assets.

Yet, the crypto market isn’t celebrating.

Bitcoin (BTC) has dropped to around $107,700, nearly reaching its first liquidity zone near $106,000. If that zone breaks, we may see a short rebound followed by a deeper move toward $103,500.

Ethereum (ETH) fell 5.3% over the last 24 hours to about $3,730, with the next liquidity zone around $3,650–$3,550. The short-term structure remains bearish unless ETH recovers and holds above $3,900.

Despite the rate cut and easing US-China trade tensions, macro uncertainty continues to weigh on the crypto market.

(Source: TradingView)

2. Institutional Interest Surges in XRP Ahead of ETF

Institutional buying of XRP has spiked ahead of the anticipated approval of an XRP ETF. Large players are positioning themselves in advance.

According to recent reports on X (formerly Twitter), Canary Capital updated its S-1 filing for a spot XRP ETF. The market could see the first XRP spot ETF launch on November 13.

On launch day, XRPR recorded $24 million in volume in the first 90 minutes. By the end of October, XRPR had reached $100 million in assets under management. If the XRP ETF launches, it is expected to generate significant interest.

(Source: Beincrypto)

3. MFAANG Earnings: Big Tech Keeps Winning

The world’s biggest tech companies — Microsoft, Meta, Amazon, Apple, Netflix, and Google — released their quarterly results, showing resilience and strong growth in cloud, AI, and services.

- Microsoft (Q1 FY2026): $77.67B revenue, EPS $4.13 — beating forecasts on AI and cloud demand.

- Meta (Facebook): $51.24B revenue, EPS $1.05 (GAAP) / $7.25 (adjusted) — revenue up but GAAP EPS hit by a one-time $15.9B tax charge.

- Amazon: $180.2B revenue, EPS $1.95 — strong AWS performance, up 20% YoY.

- Apple (Q4 FY2025): $102.5B revenue, EPS $1.85 — beat expectations; iPhone slightly below forecast, services strong.

- Netflix: $11.51B revenue, EPS $5.87 — EPS missed due to a $619M Brazilian tax expense.

- Google (Alphabet): $102.35B revenue, EPS $2.87 — first-ever $100B+ quarter, boosted by ads and cloud.

Together, these results reinforce how AI, cloud infrastructure, and digital services continue to fuel growth in the broader tech economy.

4.Onchain Revenue 2025: Crypto Moves from Speculation to Real Revenue

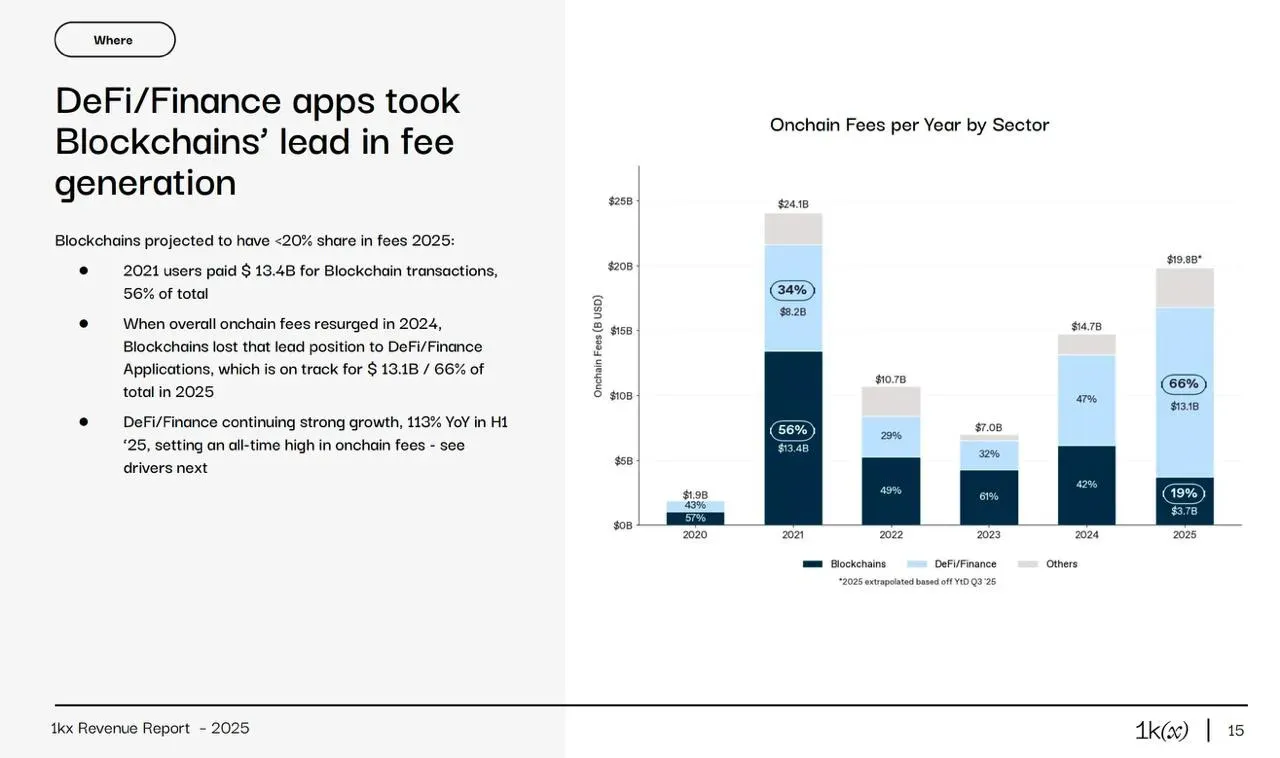

The 1kx report “Onchain Revenue 2025” shows that the total onchain revenue in crypto will reach around $20 billion in 2025, marking a +126% YoY increase compared to offchain applications, which grew just +15%. In the first half of the year, record revenues were recorded across 1,124 protocols, led by DeFi/Finance (63%), wallets (+260% YoY), consumer applications (+200% YoY), and DePIN (+400% YoY).

The report highlights that blockchain is no longer just a playground for speculation. Transparent revenue growth has become a key driver of the industry. While the top 20 protocols generate about 70% of all fees, leadership is highly dynamic — for example, Solana DEXs Meteora and Raydium grew from zero in just one year, while Uniswap lost market share.

The forecast for 2026 expects onchain revenue to rise to $32 billion (+63% YoY), driven by DeFi, wallets as business platforms, consumer apps, DePIN, and RWA.

Investors can now focus on real protocol revenue, not just token market caps. This shifts strategy toward a long-term approach to blockchain infrastructure and applications.

(Source: 1kx)

5. First Korean Won-backed Stablecoin Launches on Base

A South Korean fintech startup launched K-Won (KWON), a stablecoin fully backed by KRW deposits and operating on the Base blockchain. Local currency tokenization accelerates Web3 payment adoption in Asia and provides a new platform for regional applications.

Key Takeaways

Macro conditions are improving with liquidity set to rise, but the short-term technical outlook for BTC and ETH remains bearish — key liquidity zones are critical.

Reduce leverage exposure and maintain part of your capital in fixed-income instruments.

Consider dollar-cost averaging into strategic positions.

Learn more about how to earn up to 20% APY stress-free with weekly payouts.