Is the Crypto Market Over?

Market Snapshot

The week from November 10th to 16th was rough. BTC ~ $96k, ETH ~ $3,200. Alts fell 10–15% within 24h. Over the last month, the total crypto market cap dropped by more than $1T.

Biggest 24h decliners in the top-100: IP, AERO, JUP, PENGU, AAVE, ENA, FET, RENDER, SUI.

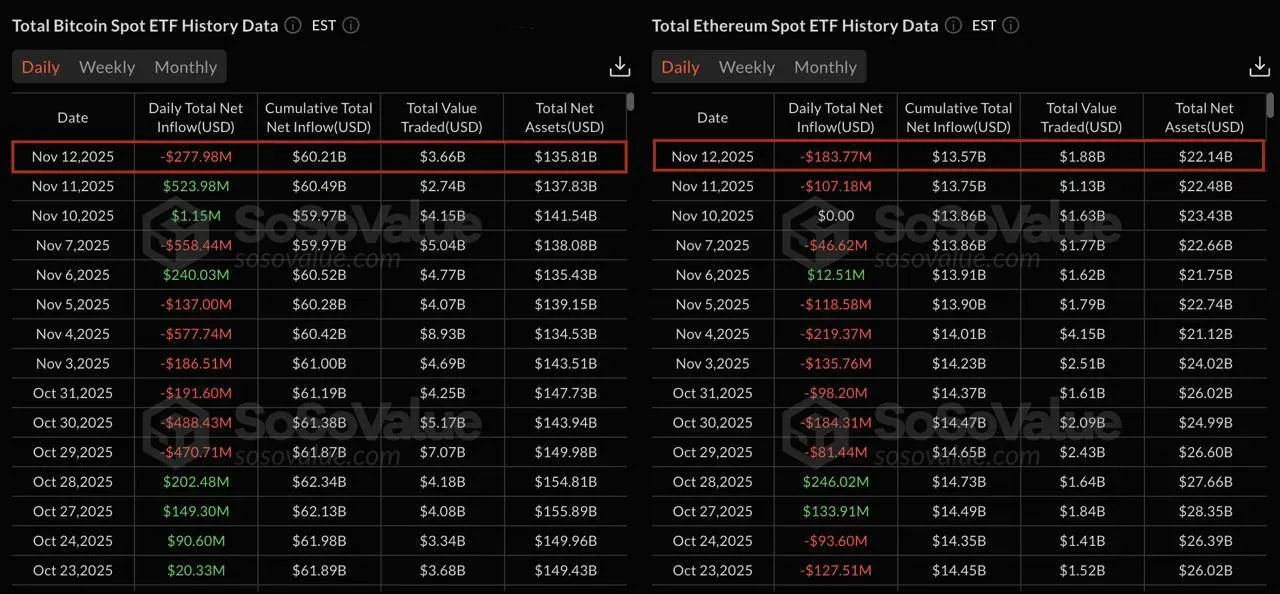

Another Round of Spot ETF Outflows

On Nov 12, spot Bitcoin ETFs saw net outflows of $277,980,000; Ethereum ETFs recorded $183,770,000 in net outflows.

(Source: SoSoValue)

(Source: SoSoValue)

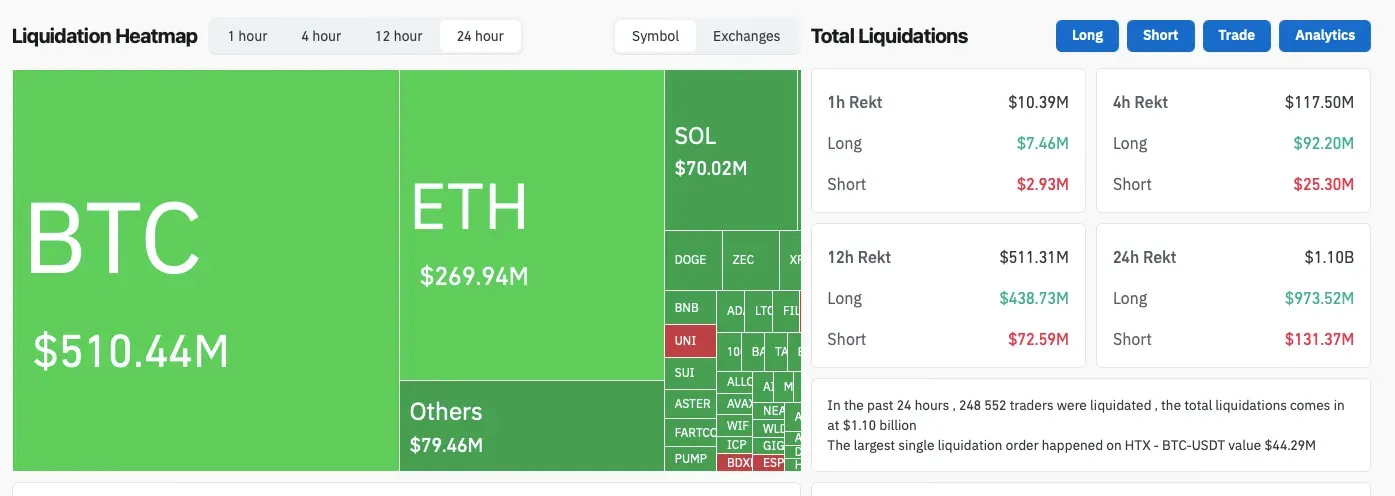

Liquidations and Positioning

On Nov 14, more than $1B in long positions was liquidated.

(Source: CoinGlass)

(Source: CoinGlass)

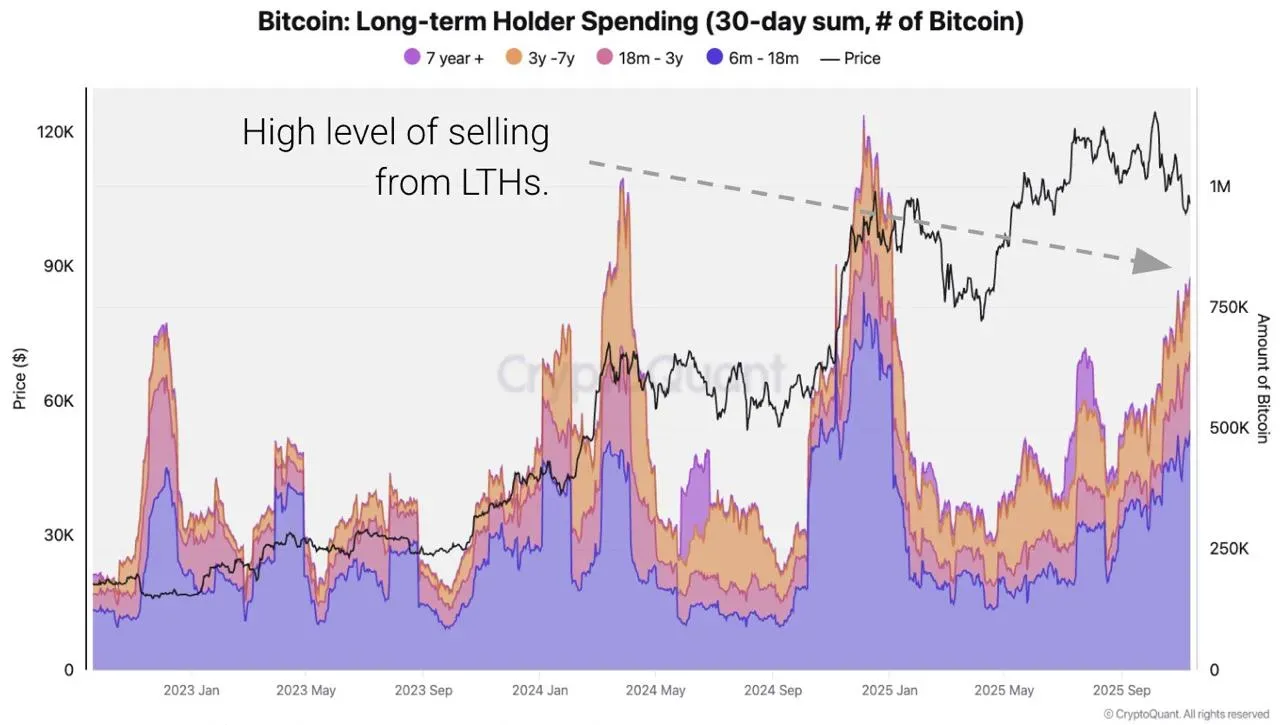

Over the past 30 days, long-term holders (LTH) sold around 815k BTC — the highest since Jan 2024. Demand weakened as selling pressure increased.

(Source: CryptoQuant)

(Source: CryptoQuant)

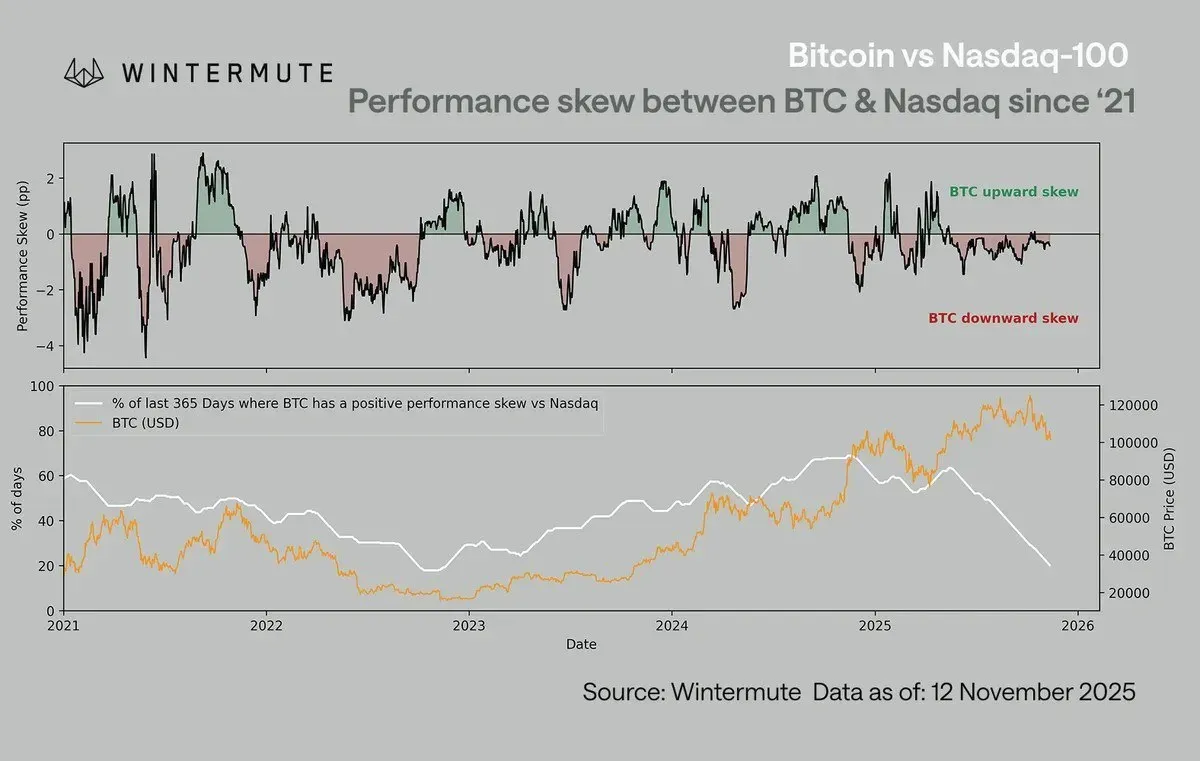

Bitcoin and the Stock Market

A new Wintermute report notes the BTC–Nasdaq-100 correlation ≈ 0.8. Synchronization is stronger on the way down than on the way up — BTC tends to move with equities mainly when things go wrong. Analysts add that this negative asymmetry historically appears closer to bottoms, not tops.

(Source: Wintermute)

(Source: Wintermute)

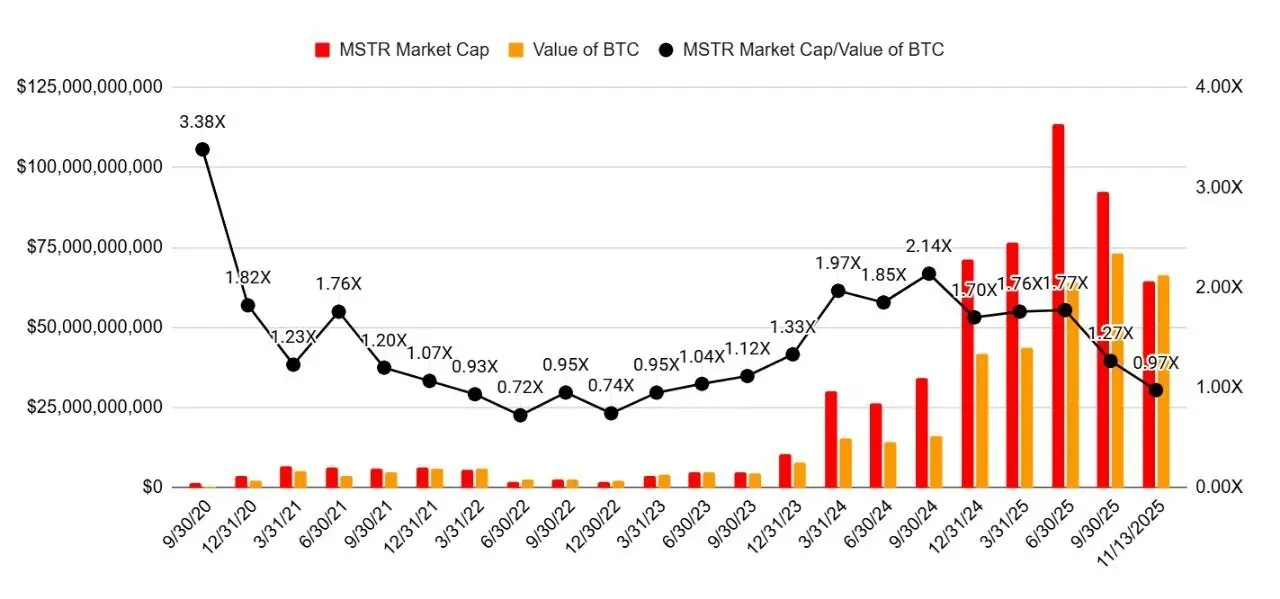

MSTR: From Premium to Discount

MicroStrategy (MSTR) long traded at a premium to its “bitcoin NAV” (BTC on the balance sheet ± operating business − debt per share) — but now trades at a discount.

Why it flipped: spot ETFs offer cheaper, cleaner exposure; MSTR carries leverage/issuances tied to BTC purchases; and in risk-off phases investors avoid extra layers and complexity.

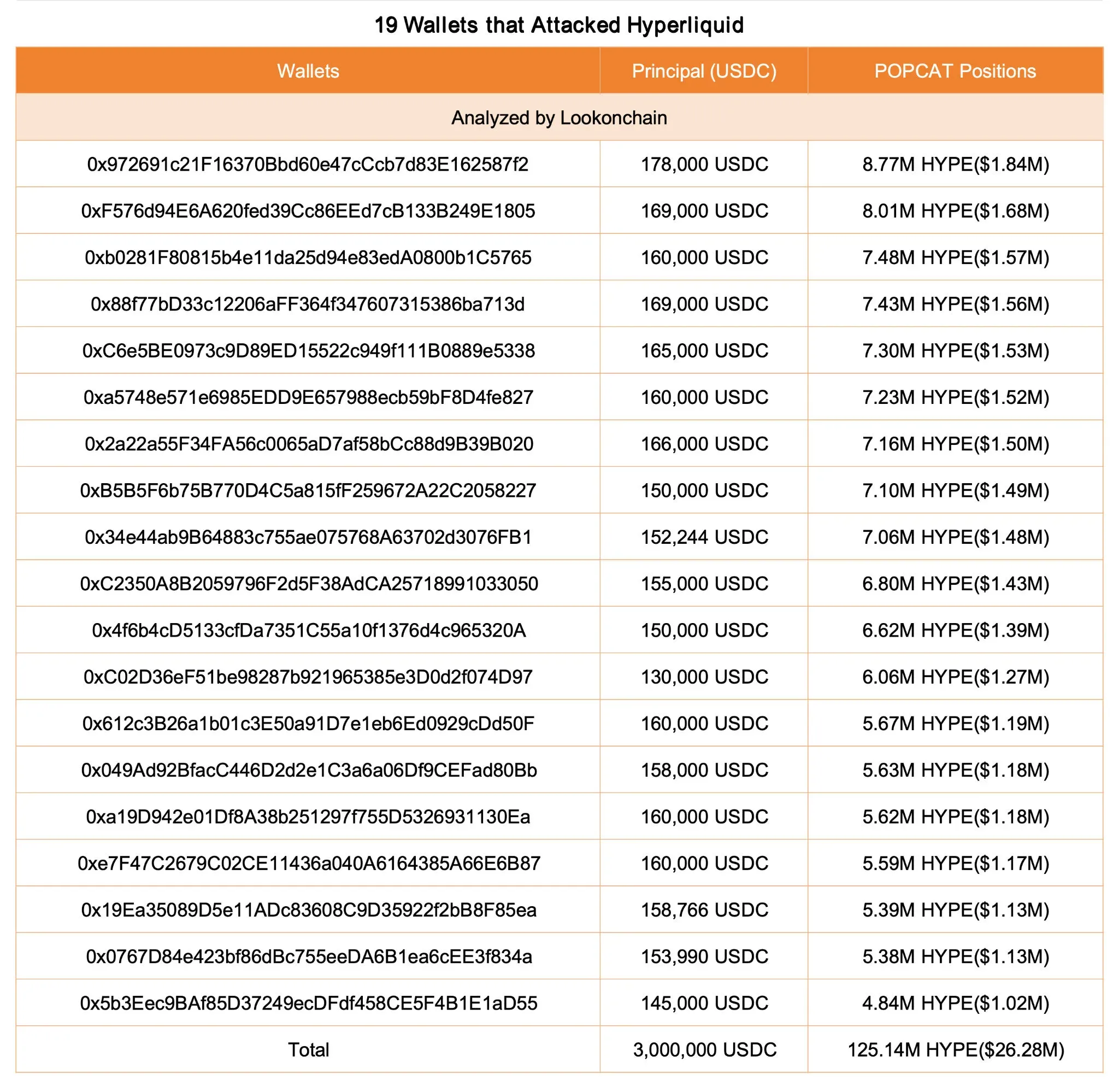

Hyperliquid × POPCAT

For the third time, Hyperliquid sits at the center of a high-profile incident. A trader moved $3M from OKX to Hyperliquid, aggressively longed POPCAT, placed a ~$30M buy wall at $0.21, then suddenly removed it.

Result: the price crashed, longs were wiped, the trader’s collateral was lost, and the HLP liquidity system took ~$5M in losses. Deposits/withdrawals were paused temporarily.

Cascading liquidations followed.

(Source: Lookonchain)

(Source: Lookonchain)

XRP ETF Sets Trading Records

Canary XRP ETF (XRPC) posted $58M in first-day volume — more than any other ETF launched in 2025 (out of 900 new funds).

What to Watch Next Week

- Flows into BTC/ETH ETFs and XRPC volumes

- Pace of LTH selling and derivatives open interest

- MSTR/NAV spread and any corporate actions (issuances/buybacks)

- Updates on Hyperliquid/POPCAT and broader infra risk

- Any signals from the Fed / U.S. budget process

If you’d rather skip the complexity, Hexn offers fixed-income products up to 20% APY, with weekly payouts and flexible risk controls.