Market Reset: ETF Inflows, Fed −25 bps, and Altcoin Support

After a tough November, the crypto market has reset: leverage came down, a chunk of speculative positions washed out. The structure looks healthier—meaning a lower chance of sharp year-end drawdowns.

Prices & Liquidations

Bitcoin is holding above ~$94,000, Ethereum trades near ~$3,300, and large-cap altcoins added 4–10%.

Shorts felt the pain: on December 9, about ~$240M in short positions were liquidated in four hours; on HTX a single order wiped a ~$24M position.

(Source: DeCentre)

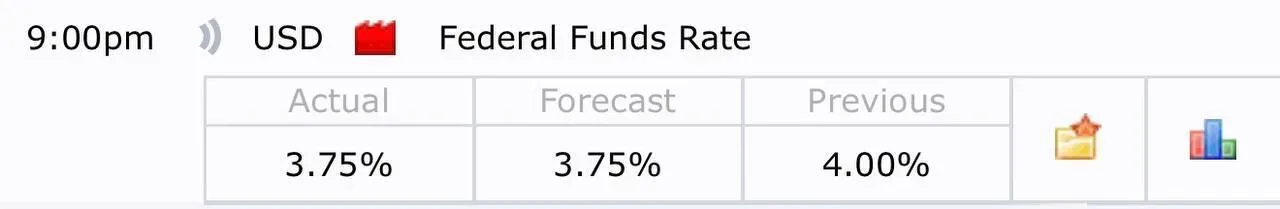

Fed Rate and U.S. Debt

The Fed cut rates by 25 bps and has already launched quantitative easing—just 12 days after winding down QT.

Current purchases are around $40B per month; experts estimate the program could run for up to a year and support risk assets. In the near term, Powell’s tone and the path of USD liquidity will set the market’s direction.

In 2026 the U.S. faces roughly $8T of debt to refinance. Large refinancing waves have historically aligned with easier financial conditions (lower rates/easing), which indirectly supports crypto—especially altcoins.

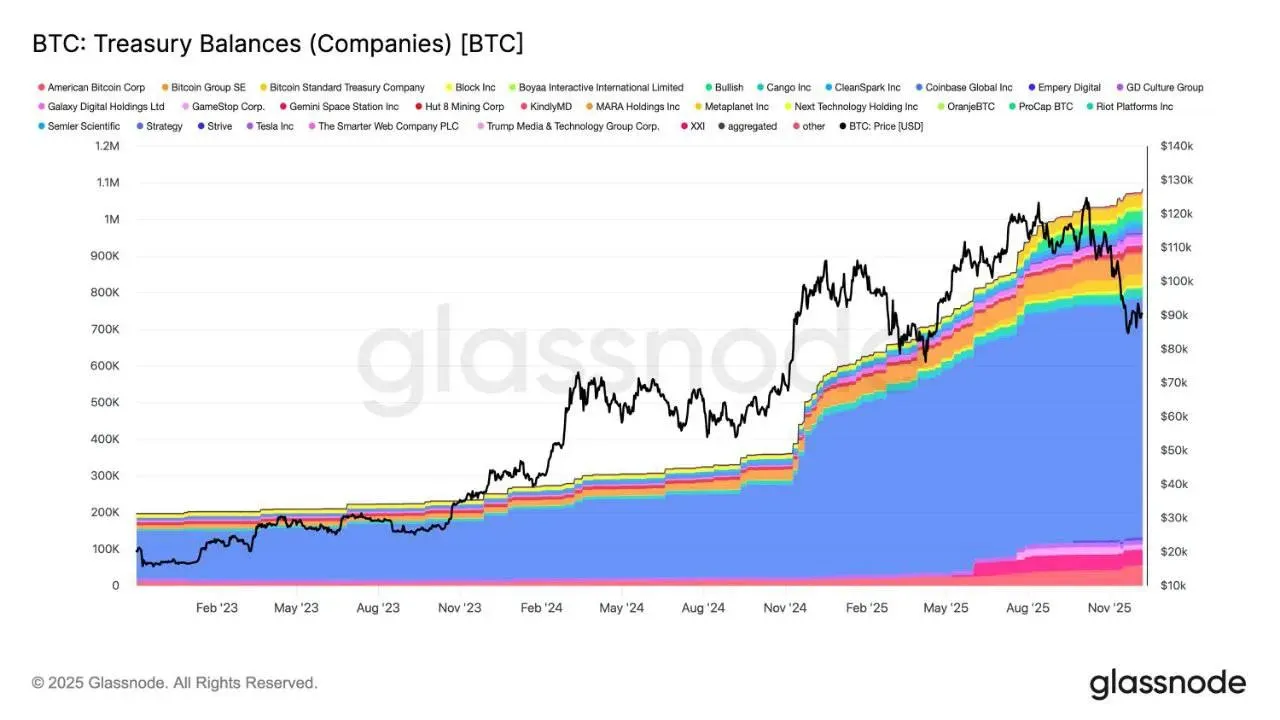

Corporate Balances

Corporate BTC reserves have reached ~1.08M BTC (vs ~197k in January 2023). The institutional share of the market keeps rising—an important anchor for demand.

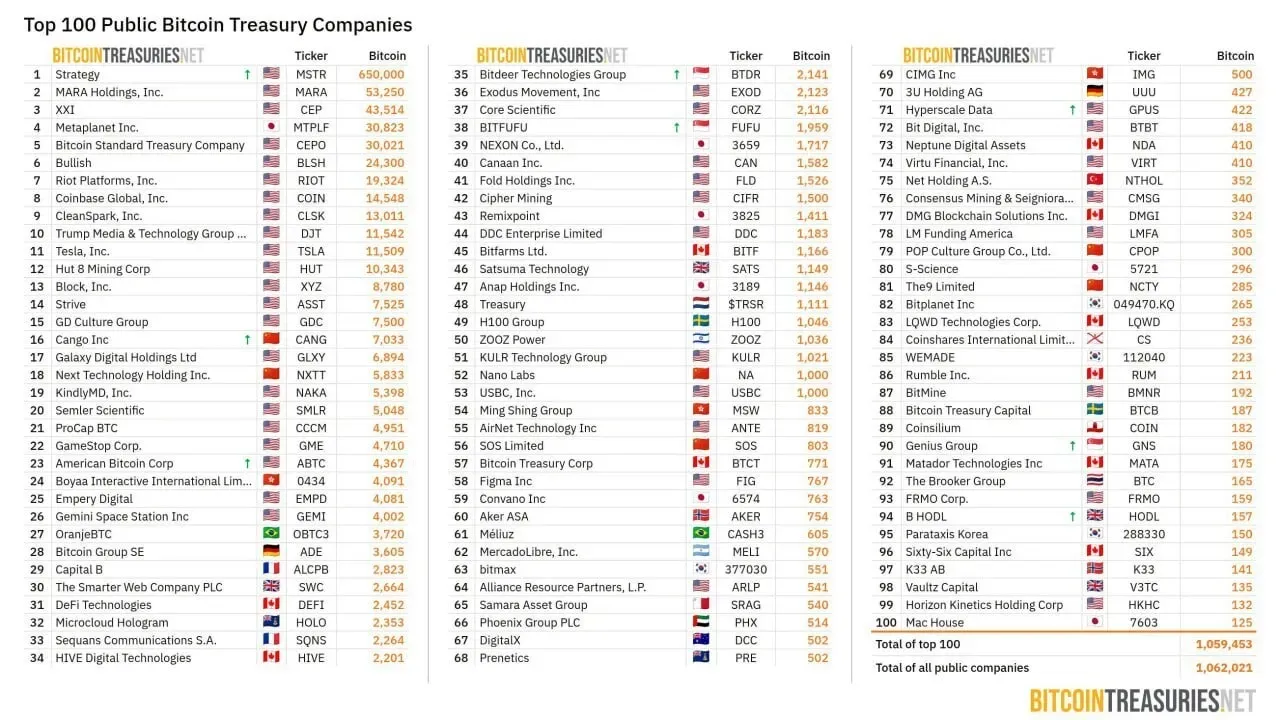

Top-100 public bitcoin holders:

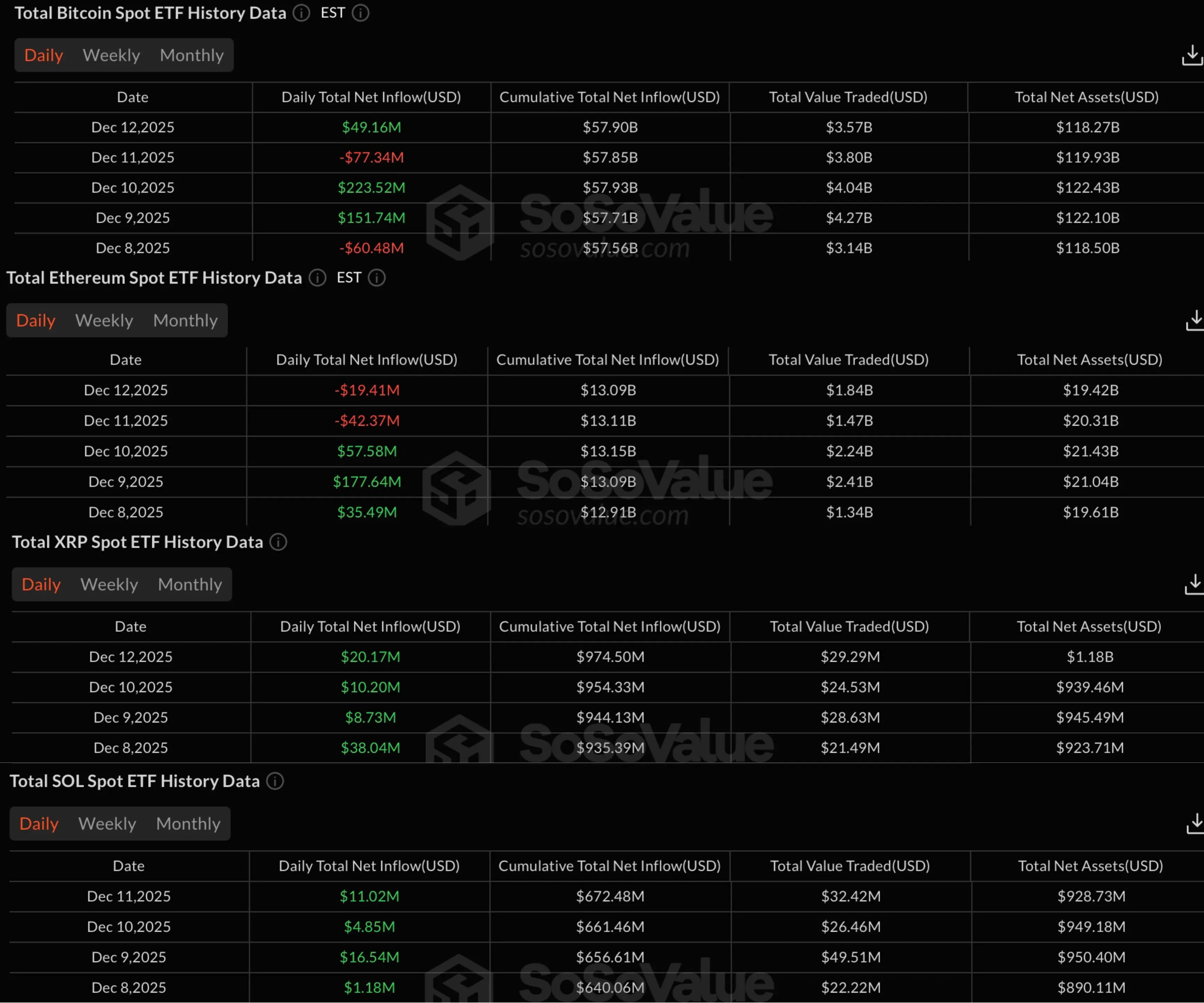

Spot ETF Flows

— BTC: +$49,160,000

— ETH: -$42,370,000

— SOL: +$20,170,000

— XRP: +$11,020,000

(Source: SoSoValue)

(Source: SoSoValue)

Poland and MiCA

Poland remains the only EU country that hasn’t adopted MiCA: parliament fell 18 votes short of overriding President Karol Nawrocki’s veto.

Takeaway

The market has shed excess leverage; ETF inflows and demand for ETH remain intact—this looks more like a window of opportunity than a cue for reckless risk. Stay disciplined and keep low-risk assets in your strategy.

Fixed-income deposits up to 20% APY, with weekly payouts and flexible risk settings — here.