Where to Look as an Investor: This Week’s Flows, Volumes, and Risks

ETF Inflows Are Rising Again

On November 26, spot ETFs saw net inflows: BTC +$21.1M, ETH +$60.8M. Even “modest” green days matter—steady inflows compound into momentum.

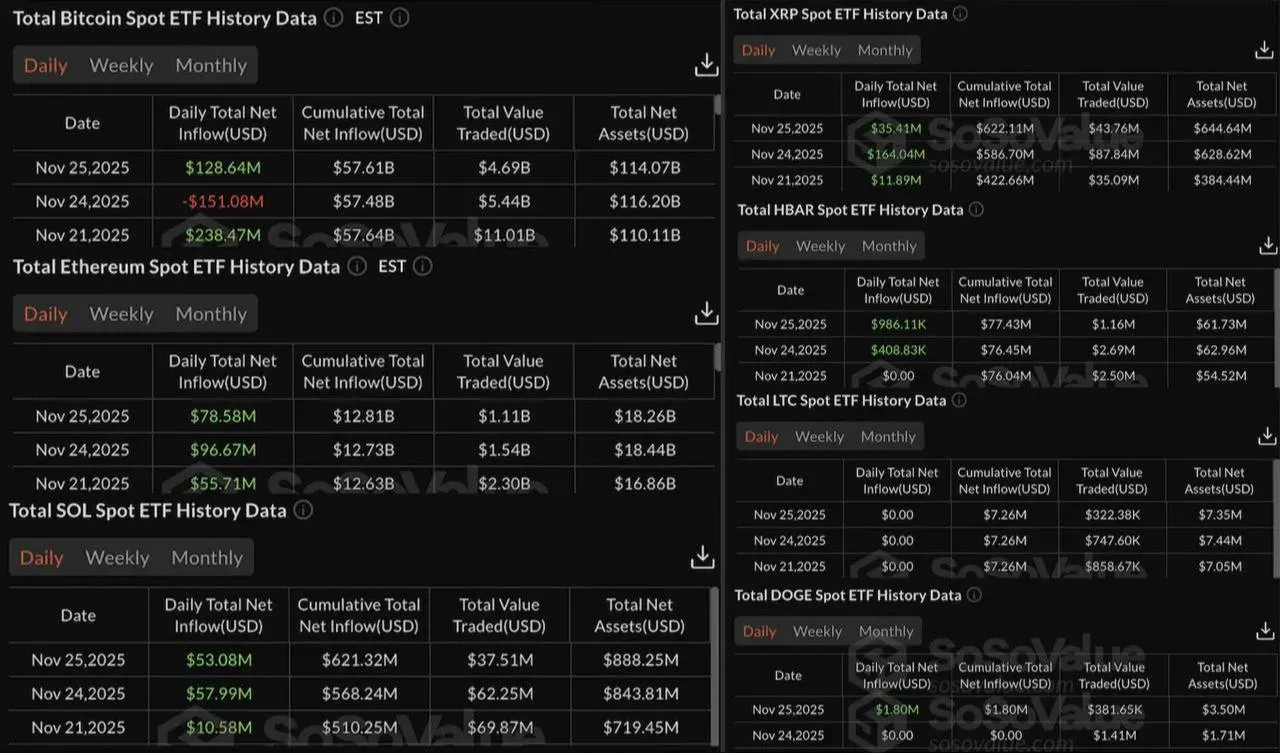

In the U.S., on one of the week’s green sessions: BTC +$128.6M, ETH +$78.6M, SOL +$53.1M (21 green days in a row), XRP +$35.4M, DOGE +$1.8M, HBAR +$0.99M.

(Source: SoSoValue)

(Source: SoSoValue)

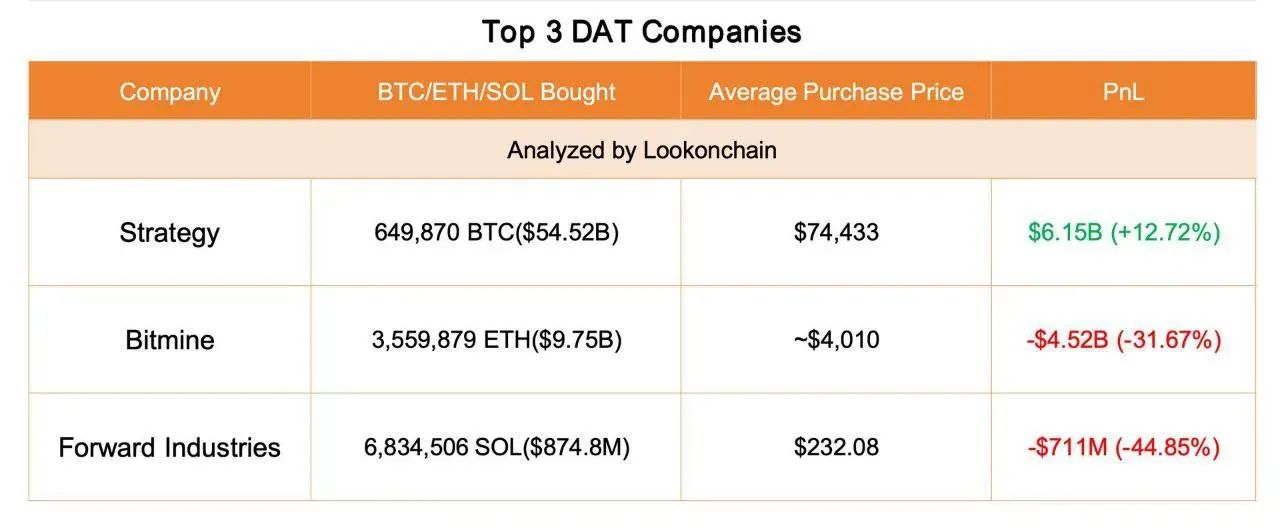

Public Crypto Treasuries: Who’s Where on PnL

- MicroStrategy is still in profit and would turn negative if BTC < ~$74,433.

- Bitmine is already underwater on its ETH positions (avg. buy ~$4,010).

- Forward Industries shows the largest drawdown on SOL (entry around $232).

(Source: Lookonchain)

(Source: Lookonchain)

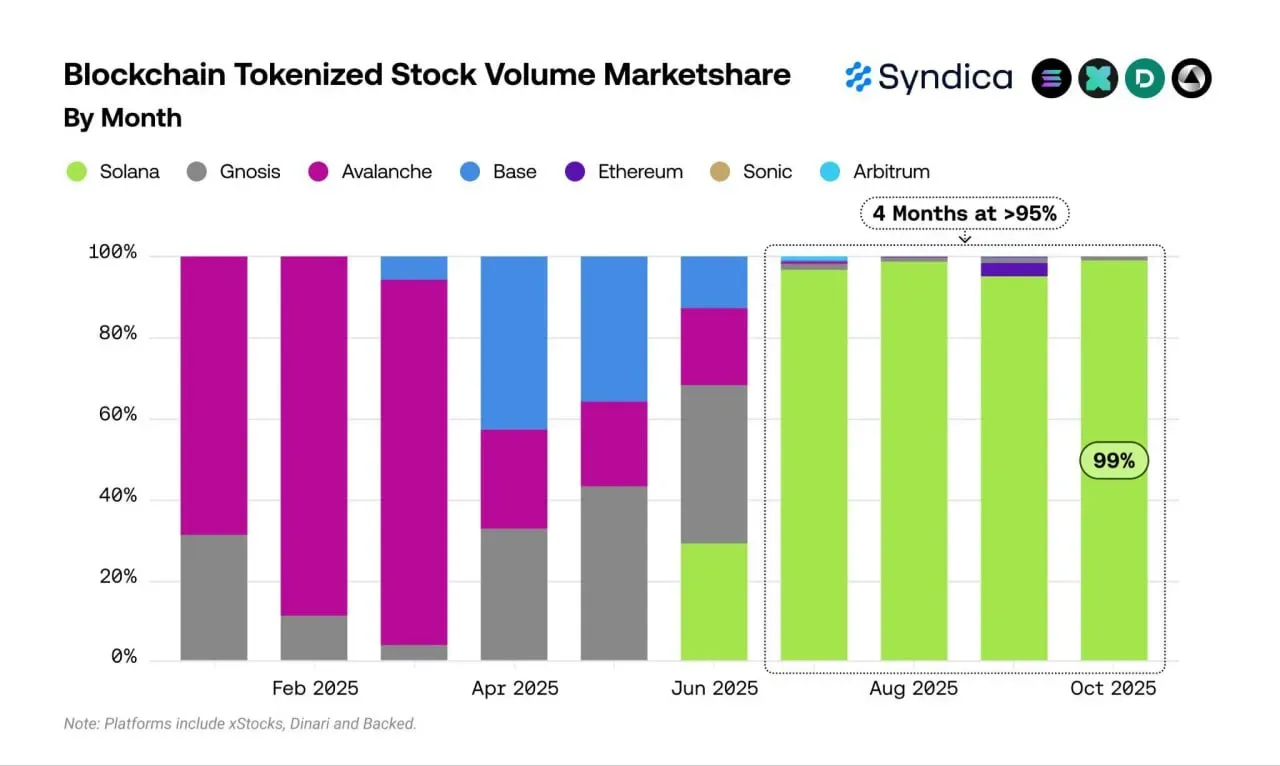

Solana Is Dominating Tokenized Stocks

For the fourth month in a row, Solana’s share of tokenized stock trading has topped 95%, hitting 99% in October. The network is cementing itself as core infrastructure for moving traditional securities on-chain. The RWA segment is becoming a real demand driver for SOL and apps built on the network.

(Source: Syndica)

Incident of the Week: Upbit Hack ~ $38M

Korea’s largest exchange, Upbit, paused deposits and withdrawals after an abnormal outflow of ~$38.5M on Solana. The assets were moved to an unknown wallet on November 27.

Infrastructure risks remain a factor even for top venues. Keep only the minimum needed on exchanges, use hardware wallets, and diversify counterparties.

What Investors Should Do Now

Volatility won’t disappear, but fresh inflows and deeper liquidity show demand for core assets is alive. Stay disciplined, don’t chase moves, and remember: a calm plan outlasts any storm better than heroics with high leverage.

With Hexn, you can use fixed-income products up to 20% APY, with weekly payouts and flexible risk settings—so you can ride out turbulence without extra stress.