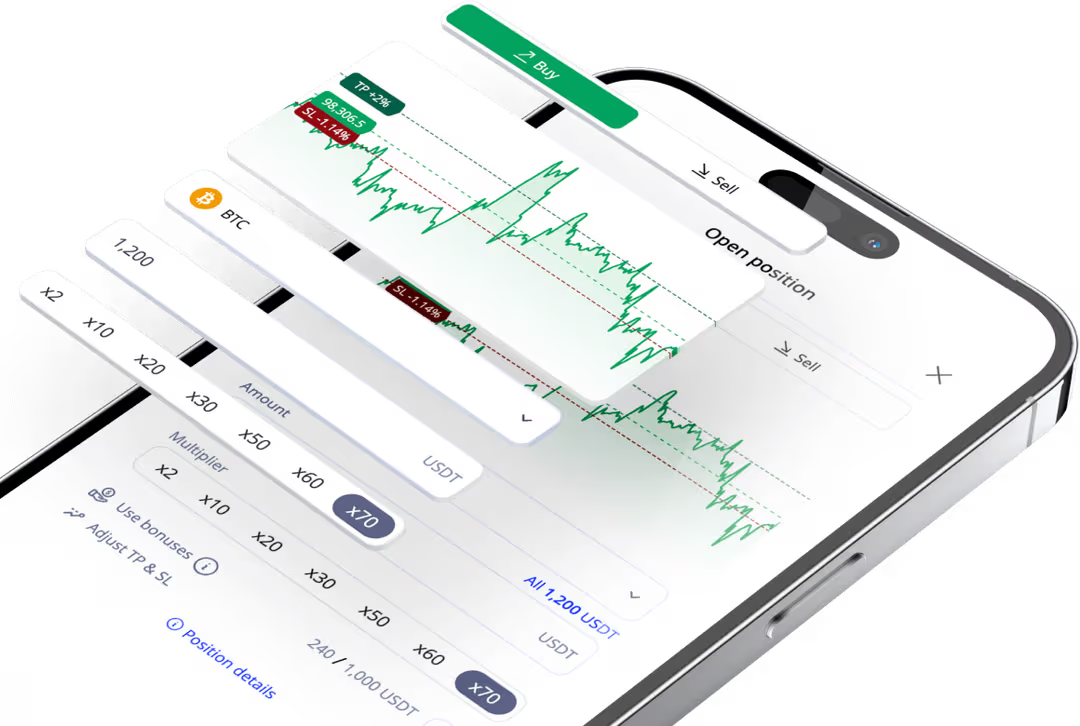

Moonrider Makes it Easy!

Our user-friendly interface lets you take advantage of market volatility anytime, anywhere — with just a few taps!Start EarningWhy Choose Moonrider?

Discover why Moonrider is your go-to for effortless and profitable crypto management. Up to 400%

Bonus on DepositsTo make your start even more enjoyable, we've included up to 400% USDT bonus for Moonrider deposits from 150 to 1000 USDT! Use this bonus to supercharge your positions.

Up to 400%

Bonus on DepositsTo make your start even more enjoyable, we've included up to 400% USDT bonus for Moonrider deposits from 150 to 1000 USDT! Use this bonus to supercharge your positions. Earn Up to 17%

Interest!Everyone deserves a break, but your money doesn’t have to! With Moonrider, your deposits keep working for you around the clock, earning daily interest at rates of up to 17% APY.

Earn Up to 17%

Interest!Everyone deserves a break, but your money doesn’t have to! With Moonrider, your deposits keep working for you around the clock, earning daily interest at rates of up to 17% APY. Keep More of What

You’ve EarnedMoonrider charges zero fees for opening or closing positions. Enjoy tight spreads and the best rates to maximize your profits without high costs.

Keep More of What

You’ve EarnedMoonrider charges zero fees for opening or closing positions. Enjoy tight spreads and the best rates to maximize your profits without high costs. Start Small,

Grow BigStart with as little as $0.9! Moonrider offers low cost of entry and great opportunities to grow your earnings.

Start Small,

Grow BigStart with as little as $0.9! Moonrider offers low cost of entry and great opportunities to grow your earnings. Your Funds

at Any TimeManage your funds easily with Moonrider. No delays—just fast deposits and withdrawals, plus a USDT bonus for your first deposit!

Your Funds

at Any TimeManage your funds easily with Moonrider. No delays—just fast deposits and withdrawals, plus a USDT bonus for your first deposit! Fund Your Account.

Your Way.Deposit with crypto or fiat via trusted networks like Onramper and onramper. Use Visa, MasterCard, Apple Pay, Google Pay, or Wallet Connect.

Fund Your Account.

Your Way.Deposit with crypto or fiat via trusted networks like Onramper and onramper. Use Visa, MasterCard, Apple Pay, Google Pay, or Wallet Connect. Start in SecondsSign up with Google, Apple, email, or Wallet Connect—or log in via Telegram to access Moonrider through HEXN’s mini-app.

Start in SecondsSign up with Google, Apple, email, or Wallet Connect—or log in via Telegram to access Moonrider through HEXN’s mini-app. Enjoy Deep LiquidityMoonrider provides deep liquidity for smooth, stable transactions. Open and close positions confidently, even in large volumes.

Enjoy Deep LiquidityMoonrider provides deep liquidity for smooth, stable transactions. Open and close positions confidently, even in large volumes.Security Verified by Experts

Tested by professionals: guaranteed protection and reliability

Proofed

by HackenPenetration testing

by HackenPenetration testing

Proofed

by HackenBug bounty

by HackenBug bounty